Executive Survey Insights Wave 35: November 8 – December 5, 2021

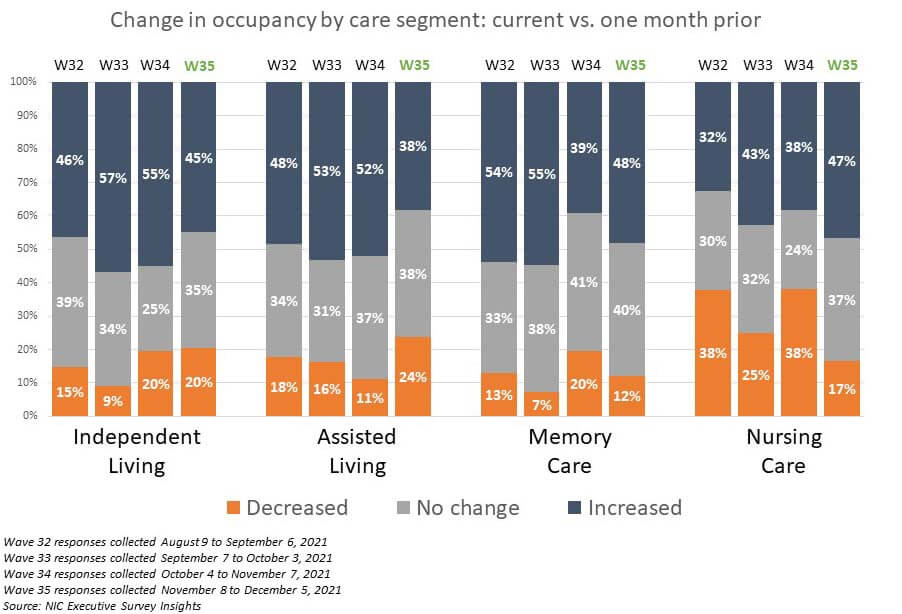

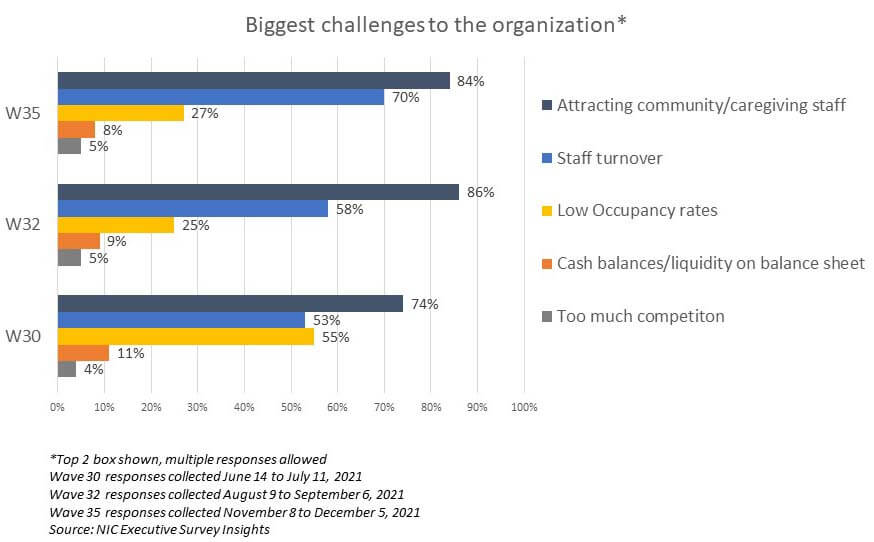

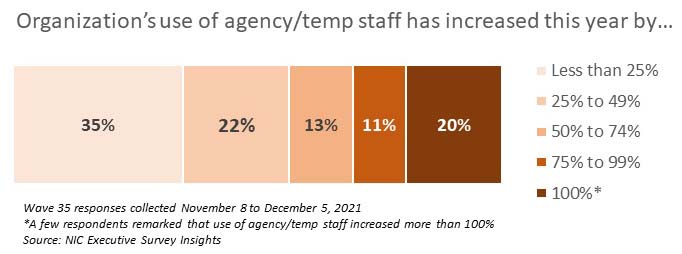

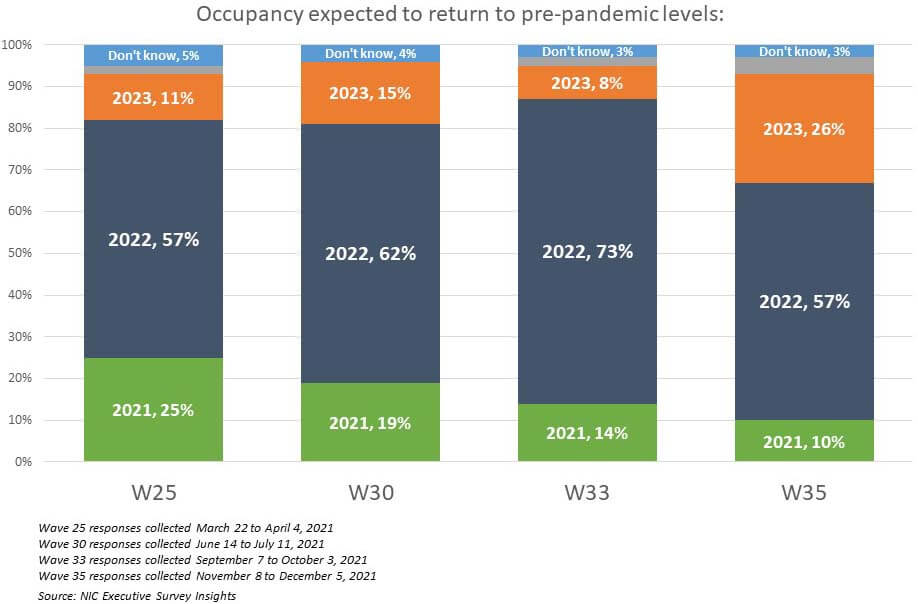

In the Wave 35 survey, nearly half of organizations with multiple properties (45%) reported staff shortages in all their properties—up from roughly one-third (30%) in the Wave 24 survey conducted mid-March. While attracting community and caregiving staff remains a significant challenge, the percentage of organizations citing staff turnover increased from about one-half (53%) to more than two-thirds (70%) since mid-June. When asked about backfilling staffing shortages, three-quarters (77%) of organizations currently employ agency or temp staff. While more than half (57%) indicated that their agency/temp staff use increased by up to 50% this year, significantly, one out of five (20%) said it increased by 100%. Nearly one-half of organizations with nursing care beds saw an improvement in occupancy (47%) up from 38% in Wave 34. Optimism regarding near-term occupancy recovery to pre-pandemic levels is flagging somewhat from recent surveys. In the Wave 33 survey conducted in September, roughly four out of five respondents expected their organization’s occupancy to recover sometime in 2021 or 2022. That sentiment shifted in Wave 35: nearly nine out of ten organizations expect their occupancy to recover in 2022 or later, with one-quarter (26%) now expecting it to occur in 2023.

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 35 survey includes responses from November 8 to December 5, 2021, from owners and executives of 72 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 35 Summary of Insights and Findings

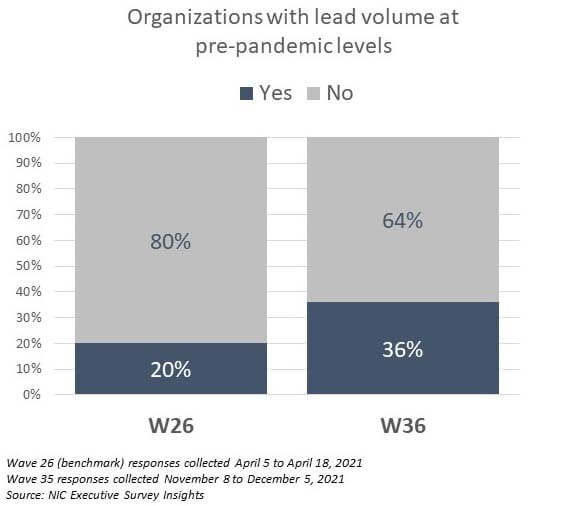

- Lead volumes are improving. In Wave 35, more than one-third of organizations had lead volume at pre-pandemic levels (36%), up from 20% in April 2021 (and 33% in Wave 34).

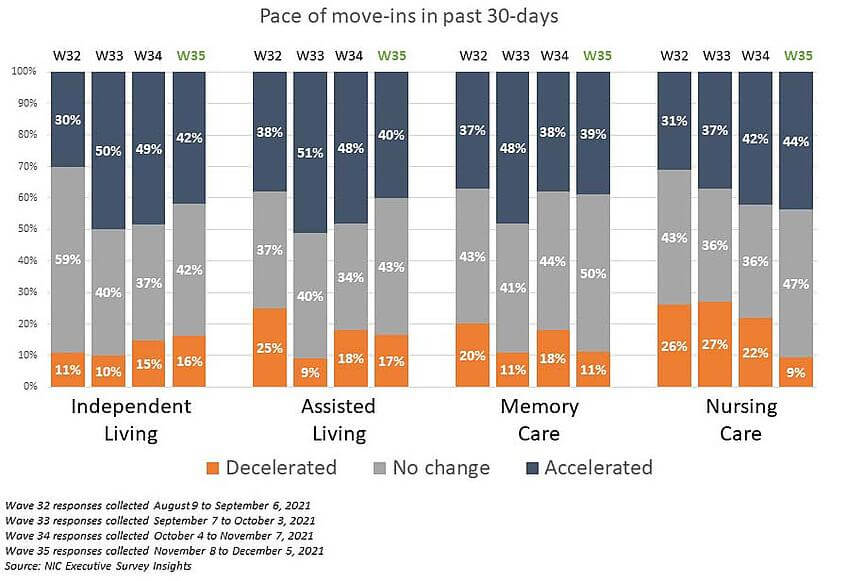

- The share of organizations that reported that the pace of move-ins accelerated in the past 30-days did not change significantly in Wave 35. Between 39% and 44% of organizations reported an acceleration in their pace of move-ins, with the range varying based on the care segment type. Presumably, due to need-based moves rather than choice-based moves, fewer organizations with nursing care beds reported a deceleration in the pace of move-ins since the summer when the delta variant of the COVID-19 virus was in broad circulation.

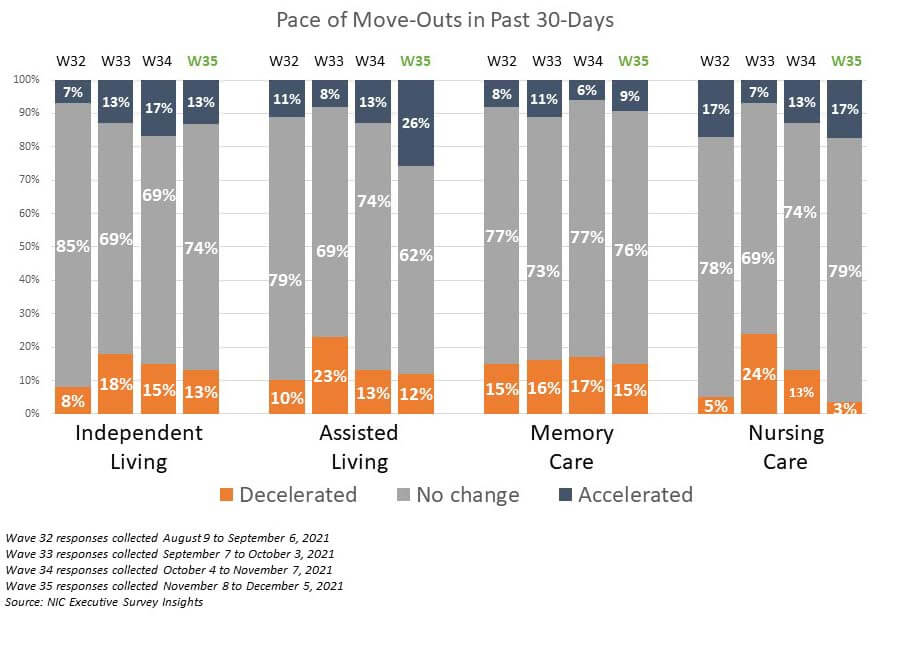

- Considering the pace of move-outs in the past 30-days, no change was reported by the majority of organizations across care segments. However, one-quarter of organizations with assisted living units (26%) noted an increase in the pace of move-outs.

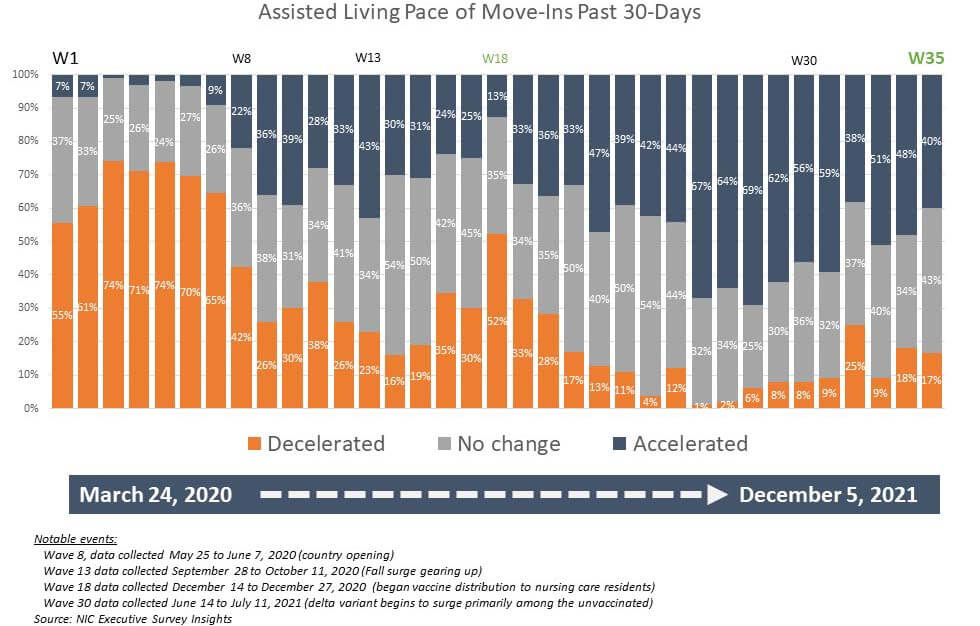

- The chart below illustrates the pace of move-ins experienced by organizations with assisted living units across their portfolio of properties since the beginning of the pandemic (impacting events are observed in the footnotes). The recent slowdown in the pace of move-ins since the Wave 30 survey conducted in June may be due to the spread of the COVID-19 delta variant or waning pent-up demand following the unprecedented third quarter 2021 pace of absorption tracked by NIC MAP, or it could be due to typical patterns of seasonality. The omicron variant may add some uncertainty until we learn more about its characteristics.

- In Wave 35, one-quarter of organizations with assisted living units (24%) saw a decline in occupancy typically associated with natural attrition and transfers to memory care and/or nursing care segments, both of which saw more growth in occupancy than in the prior survey. Nearly one-half of organizations with nursing care beds saw an improvement in occupancy (47%), up from 38% in Wave 34.

- Since the Wave 33 survey conducted in September, the share of organizations (of all sizes ranging from single properties to hundreds of properties) reporting staff shortages have oscillated around 100%. Digging deeper, in the Wave 35 survey, nearly half of organizations with multiple properties (45%) reported staff shortages in all their properties—up from roughly one-third (30%) in Wave 24 conducted mid-March.

- Respondents are routinely asked to rank the biggest challenges facing their organizations. Since August, more than four out of five respondents indicated that attracting community and caregiving staff was among their biggest challenges. As shown below, challenges due to staff turnover increased from about half (53%) to more than two-thirds (70%) since mid-June.

- NOI has been pressured for many operators due to the impact of labor shortages and higher wages on expenses, rising insurance costs, inflation-related higher-priced materials, the pandemic-related decline in occupancy rates, and the inability to grow rents. When asked how they are backfilling staffing shortages, 100% of respondents cited overtime hours since Wave 31 (data collected between July 12 and December 5). Currently, 77% of organizations indicated using agency or temp staff.

- In Wave 35, a new question was asked to better understand and track operators’ employment of expensive agency/temp staff to backfill staffing shortages. As shown in the chart below, more than half (57%) indicated that their use of agency/temp staff increased by 50% this year. However, one out of five surveyed (20%) said it increased by 100% (and a few respondents remarked that it increased more than 100%).

- Optimism regarding near-term occupancy recovery is flagging somewhat from recent surveys. In Wave 33 conducted in September, roughly four out of five respondents expected their organization’s occupancy to return to pre-pandemic levels sometime this year or in 2022. That sentiment shifted in Wave 35. Currently, nine out of ten organizations (87%) expect their occupancy recovery to occur in 2022 or beyond, with one-quarter (26%) now expecting it in 2023.

Wave 35 Survey Demographics

- Responses were collected between November 8 and December 5, 2021, from owners and executives of 72 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise roughly two-thirds (63%) of the sample. Operators with 11 to 25 and 26 properties or more make up 37% of the sample (18% and 19%, respectively).

- Approximately one-half of respondents are exclusively for-profit providers (54%), one-third operate not-for-profit seniors housing and care organizations (33%), and 13% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 69% of the organizations operate seniors housing properties (IL, AL, MC), 19% operate nursing care properties, and 39% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance.

The current survey is available and takes 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and create a comprehensive and honest narrative in the seniors housing and care space at a time when trends are continuing to change in our sector.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.